Ethereum’s Wrapped Bitcoin to Now Operate as Top Cryptocurrency Payment Layer

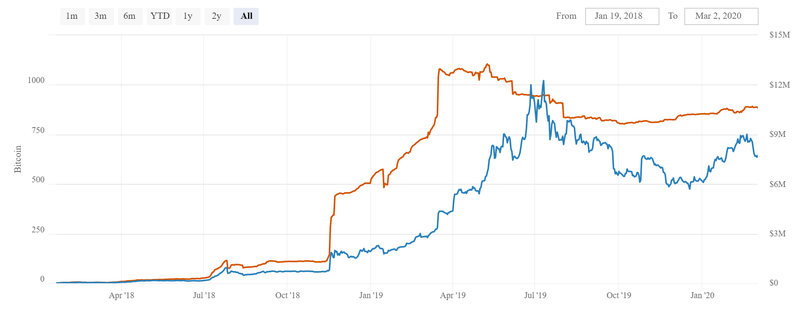

Bitcoin circulation on Ethereum Network can only be possible with wbtc. According to the Bitcoin Visuals report, the Bitcoins circulating on the Ethereum network are much more than the amount circulating in the Lightning Network. In June 2017, Bitcoins in Lightning Network witnessed its all-time high of 953 and since then it has declined reaching its lowest of 883.4. The Bitcoins circulation on the Ethereum Network is due to the tokens provided by Ethereum’s Wrapped Bitcoin.

At the same time data from DeFi Pulse indicates its all-time high of 989 BTC locked in the network.

In early 2018 the Lightning Network’s capacity started growing and by the end of that year the Network enjoyed great growth. The lightning Network entered 2019 to see its humongous growth and witnessed its all-time high. However since then its been in a declining mode because of continual withdrawal of funding. Large amount of nodes with large amount of capacities were created, to set up these nodes an estimated amount of $1000 for transaction fee was spent.

DeFi Pulse data shows that the Bitcoins present on the Ethereum Network due to the Wrapped Bitcoin tokens have reached 888 BTC. This report has been confirmed by the official webpage of the token.

Background of Wrapped Bitcoin Token

The Wrapped Bitcoin token was propelled back in February 2019 and is basically an ERC-20 token sponsored 1:1 by the leader digital currency. The task was propelled by BitGo, in a joint effort with the Kyber Network and Republic Protocol. Its utilization in the decentralized money space has been developing gratitude to the foundation suppliers offering it support.

Wrapped Bitcoin’s Rise!

In July 2019, open-source loaning stage Compound included help for wBTC, permitting clients to gain enthusiasm on their BTC property by means of the wrapped token on the Ethereum blockchain. NEO-based cross-chain nuclear swap trade Switcheo has additionally included help for wBTC, making it tradeable on a decentralized trade that permits clients to exchange across different blockchains.

The token likewise likely profited by the development in the decentralized account space, which outperformed $1 billion in complete worth totally a month ago, tanks to developing cryptographic money costs. After an undertaking on the space was misused, in any case, financial specialists pulled back 200,00 ETH from it. The DeFi space has since been recovering.