What is Bitcoin Halving – History, Prediction, Price Chart

Table of Contents

Gold as a medium of exchange is continued from six thousand years back. This is because its supply is limited, which is the basic reason why it is considered as a hedging asset. Gold is a safe-haven asset because it is not vulnerable to inflation and acts well in a financial crisis. Bitcoin, on the other hand, is a first-ever digital asset that does not have any physical existence.

Bitcoin is also unique and can survive for more than one hundred years due to its underlying technology and limited supply. That’s why most people relate Bitcoin with physical gold. To keep the status of Bitcoin as a top hedging status, its creator impregnated halving after every four years to maintain its price value. In this article, Bitcoin halving explained in an easy way with detailed information.

What is Bitcoin Halving 2020?

It is sure that you are already aware of the most-used blockchain term ‘’Bitcoin Halving’’ because it is a very crucial event in the history of Bitcoin.

Putting in simple words, the mining reward cut into half after completing 210,000 blocks. The halving is the thing that keeps Bitcoin more special than other assets as it controls and stables the inflation of the top digital currency.

The upcoming halving- ‘’ Bitcoin Halving 2020’’- is a few days away, and the crypto community is anxiously waiting for this as there are many predictions and speculations attached to it. While ‘’Bitcoin Halving 2024’’ is four years away when the next 210,000 blocks will complete.

Bitcoin Halving Dates History

| BTC Event | Happening Date | Blocks | Mining Reward | New BTC between two Events |

| Bitcoin Creation | 3 January 2009 | 0 | 50 BTC | 10,500,000 |

| First Halving | 28 November 2012 | 210,000 | 25 BTC | 5,250,000 |

| Second Halving | 9 July 2016 | 420,000 | 12.5 BTC | 2,625,000 |

| Third Halving | Expected in mid-May | 630,000 | 6.25 BTC | 1,312,500 |

| Fourth Halving | Expected in 2024 | 740,000 | 3.125 BTC | 656,250 |

Why does Bitcoin halve?

The answer to this question beautifully explains the purpose of why Bitcoin was created by Nakamoto and how it is changing the global financial network by removing the third-party role at all. The Bitcoin creator felt the need for digital money which can be used over the internet. To circulate it efficiently and for its survival for more than 100 years, he made its protocol very unique and invulnerable to hack.

The total game is hanging between demand and supply. For example, if a supply of the product goes down while its demand in the market is going up then it’s price will automatically go up. The same principle applies to why bitcoin halving occurs.

To maintain the price of Bitcoin and to resist price inflation, Nakamoto designed the protocol that needs halving after every four years when 210,000 blocks complete. If the supply of coins will continue into markets, there will be enough numbers of Bitcoins available in the markets.

When the quantity is high, the demand will come down as a result. The low demand is directly proportional to the low price of the coin. That’s the reason behind cutting minting rewards so that scarcity of the coins can have a stable value.

What will happen after Bitcoin halving?

It is supposed that several miners will leave the mining world as the mining reward will cut from 12.5BTC to 6.25 BTC. This is because they cannot manage and afford the expensive process as electricity consumption is very expensive while the profit comparatively is low. This is for individual miners who are running miners on their own. The giant companies in the mining field will not do this as they have powerful machines consuming less power.

Another factor is also involved which can be expressed in the words that the sudden decline in the hashing rate after the halving could be recovered after some time. The presence of high hashing is necessary for the survival and stability of the Bitcoin.

In 2012, when the first-ever reward cutting process occurred, the network hash rate reduced from ‘’ 27.61 THash/s to 19.98 THash/s.’’ After the time frame of six months, it rose to 60 THash/s, thus expanding miners’ ecosystem again.

Similarly, when dates back to 2016, the Bitcoin’s second halving year, the hash rate figure dropped from ‘’ 1.56 EHash/s to 1.40 EHash/s’’ amid coin’s halving.

So, we can say that the hashing capability of the blockchain will reduce suddenly after the reward reduction. This will enforce inefficient miners to shut down their systems, but overall, this empty place will be covered-up by large-scale firms and companies. Nowadays, the individual trend is gone as big firms do the mining process on the behalf of people, and in turn, receive money for expenditures including, electricity expenses.

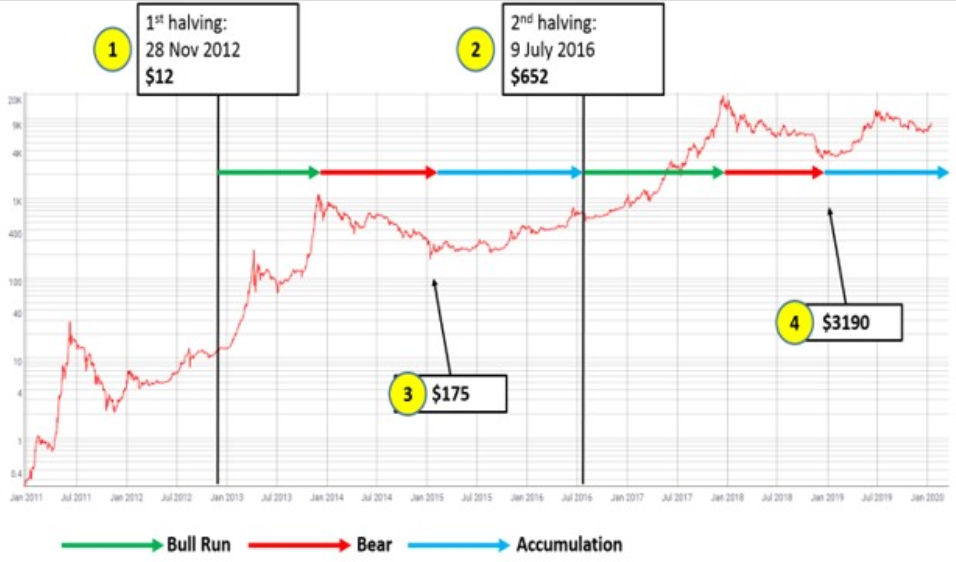

Bitcoin Halving Price Chart

Will Bitcoin go up after halving?

This is a much-asked question in the crypto community as traders and investors want to know whether the price will increase or not after this event. This is true to some extent, but some analysts say there will be no effect at all on the price value. For the past two bitcoin halving events, 2012 and 2016, there was little bullish momentum, and price surged by some percentage.

Following the past ones, people have eyes on the upcoming one which will happen in mid-May. They have a lot of expectations from the leading asset in terms of its value. Many renowned personalities in the crypto world have big predictions for Bitcoin’s price from ‘’Halving 2020.’’

Bitcoin Halving Price Prediction

There are two schools of thought in this perspective. According to the first one, the price value of digital gold will go up. They believe in the analogy of supply and demand and this theory seems logical when seeing from a financial perspective. If bitcoins mint by miners in a low amount, then the fewer coins will add into circulation. As a result, there will be a scarcity of BTC in the crypto markets, the shortage supplied with high demand will push the value upward.

On the other hand, there are some who say that price will not be affected by halving. The hypothesis is based on some reasons which are to some extent are true and knowledgeable. Miners, who will close the mining operations, will sell their assets, thus the addition of more digital coins.

Secondly, future trading is now becoming popular which removes the need for Bitcoins’ presence for trading. Thirdly, there is enough quantity of Bitcoins in circulation, and a decrease in minting ratio will pour minimum influence on the coin value.

Conclusion

In this detailed guide article about halving, everything is explained in-depth with facts and figures. In the above table, the next bitcoin halving date is also mentioned. Bitcoin halving meaning is decoded in simple words so that everyone comes to know about Bitcoin’s crucial event.

You can monitor the Halving countdowns from the following sites:

Frequently Asked Questions

Does Bitcoin halving affect Altcoins?

The correlation between Bitcoin and altcoins is significant as Bitcoin always affects altcoins including Ethereum, Ripple, and others coming at lower ranks in terms of the trading volume. In the past, whenever the BTC price changed, there was also great pressure on altcoins. The coming important event definitely has an impact on the price analysis of altcoins.

How many Bitcoins are left?

Currently, almost 18,313,625 BTC are in existence which counts 87% of the whole supply. And these numbers are changing every ten minutes with the addition of 12.5 BTC. 2,686,375 Bitcoins are left to be mined. And the minting of total bitcoin will be completed in 2140.

How often is Bitcoin halving?

Bitcoin halving occurs every 4 years when blockchain tops 210,000 blocks. This process will continue until 21 million coins come into existence.